The demand for comprehensive tick data and derived analytics has never been greater. In an increasingly complex global market environment, and with explosive growth in volumes, trading venues face growing challenges in managing and monetising their data effectively.

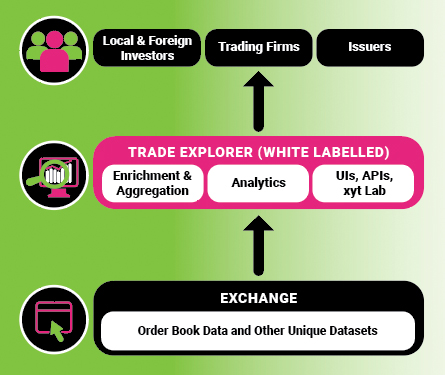

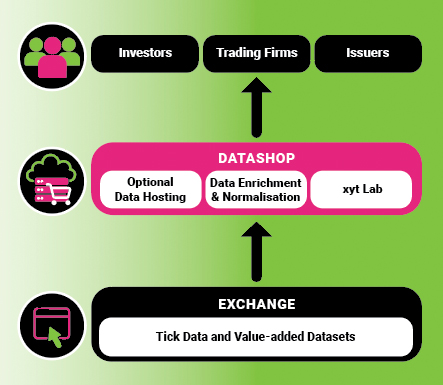

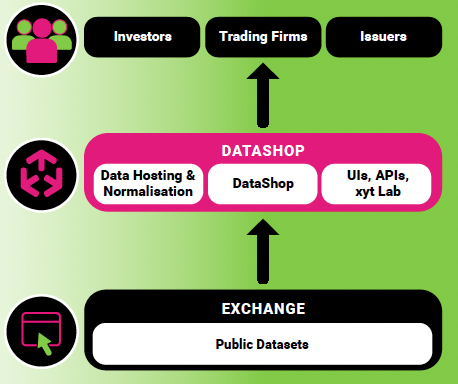

big xyt ecosystems offers a proven and mature solution that addresses these challenges, enabling trading venues to leverage their unique datasets, provide easy access for their customers to their data, enhance customer engagement, and create new revenue streams.